At The Thomas Duke Company, we pride ourselves on helping our clients make the most of their real estate investments. One of the most powerful tools available to savvy investors is the 1031 exchange. This provision, named after Section 1031 of the Internal Revenue Code, allows property owners to defer capital gains taxes when they sell one investment property and reinvest the proceeds into another. This strategy not only helps maximize investment capital but also provides significant tax advantages that can build wealth over time.

For those unfamiliar with how a 1031 exchange works, navigating the process can feel daunting. However, with the right knowledge and guidance, it becomes a practical way to reinvest real estate assets while delaying a sizable tax bill. In this blog, we’ll walk through the steps, benefits, and common misconceptions about the 1031 exchange, while illustrating how it can help you grow your real estate portfolio without the immediate tax burden.

A 1031 exchange allows you to defer paying capital gains taxes when you sell one investment property and reinvest the profits into another. This exchange must adhere to specific guidelines laid out by the IRS, but when done correctly, it can allow real estate investors to defer taxes indefinitely by continuously rolling over properties into new investments.

The core advantage of this tax strategy is that it helps preserve your equity, allowing you to put the entire sale amount toward the purchase of a new property, rather than setting aside a portion to cover taxes. By leveraging this tax deferral, investors can scale their real estate portfolios, moving into larger or more lucrative properties over time.

A 1031 exchange offers several financial advantages, making it a popular choice for property owners looking to grow their investments. Here are the primary benefits:

Wealth Preservation: Over time, an investor can utilize a 1031 exchange multiple times. This means you can continually defer taxes, preserve your wealth, and pass down real estate assets to future generations with minimal tax consequences.

While the benefits of a 1031 exchange are clear, it’s important to understand the process and requirements in order to take advantage of this tax deferral strategy. Here’s a step-by-step guide to executing a successful 1031 exchange:

The process begins with the sale of your current investment property. It’s important to note that this property must be used for investment or business purposes. If it’s a primary residence or vacation home, it won’t qualify for a 1031 exchange.

When selling the property, the sale proceeds must go to a qualified intermediary (QI) rather than directly to you. The QI will hold the funds while you identify and purchase a replacement property. This is a crucial step, as receiving the sale proceeds yourself will disqualify the transaction from being a valid 1031 exchange.

The IRS gives you a 45-day window from the date of the sale of your original property to identify potential replacement properties. You can identify up to three possible properties, regardless of their value, or more than three if their combined value doesn’t exceed 200% of the value of the sold property.

This is known as the 45-Day Identification Period, and it is a firm deadline. The properties you identify must be like-kind, meaning they must be used for investment or business purposes, though they don’t have to be the same type of property. For instance, you could sell an industrial building and buy a multifamily apartment complex or a retail space.

Once you’ve identified potential properties, you have 180 days from the sale of your original property to close on one of the identified replacements. This is referred to as the 180-Day Exchange Period, and like the 45-day identification period, this deadline is non-negotiable.

The QI will use the sale proceeds from your original property to complete the purchase of the replacement property, ensuring that the funds are handled properly to meet the IRS guidelines. If you fail to close within 180 days, the exchange will be disqualified, and you’ll be required to pay taxes on the capital gains from the original sale.

One of the key features of a 1031 exchange is the flexibility it provides in the types of properties you can exchange. While the term “like-kind” might suggest that you need to buy a property identical to the one you’re selling, that’s not the case. The IRS allows you to exchange a wide variety of property types as long as they are held for investment or business purposes.

For example, you can sell a retail building and purchase an office building, or swap an industrial property for a parcel of land. The possibilities are broad, and this flexibility allows investors to diversify their portfolios and take advantage of opportunities in different real estate sectors.

This is particularly useful for investors who want to transition from one type of asset to another, such as moving from a commercial office space to multifamily housing or from land to a retail property.

The strict timelines involved in a 1031 exchange are what make the process challenging for some investors. The two key deadlines to remember are:

Adhering to these deadlines is crucial for maintaining the tax benefits of a 1031 exchange. Working with a qualified intermediary and experienced real estate professionals can help ensure the process goes smoothly.

While 1031 exchanges are incredibly beneficial, there are a few misconceptions that we often hear from clients. Let’s clear those up:

While the benefits of a 1031 exchange are undeniable, the process is complex, and the IRS rules must be followed closely. This is why it’s essential to work with professionals who understand the intricacies of the exchange process. At The Thomas Duke Company, we have a proven track record of successfully guiding clients through 1031 exchanges, ensuring they maximize the benefits and meet all the necessary requirements.

From identifying potential replacement properties to managing timelines and paperwork, our team has the experience and knowledge to help you navigate the entire process smoothly.

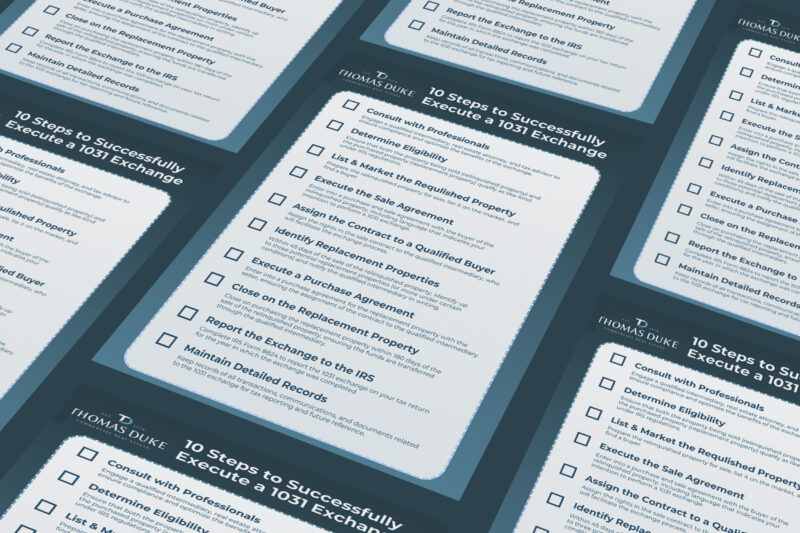

Curious how to execute a 1031 exchange?

If you’re considering a 1031 exchange or want to learn more about how it can help you grow your real estate portfolio, we’ve put together a comprehensive 10-step checklist to guide you through the process.